property tax bill las vegas nevada

Property tax revenue in the same period has not kept pace. Doing Business with Clark County.

Mesquitegroup Com Nevada Property Tax

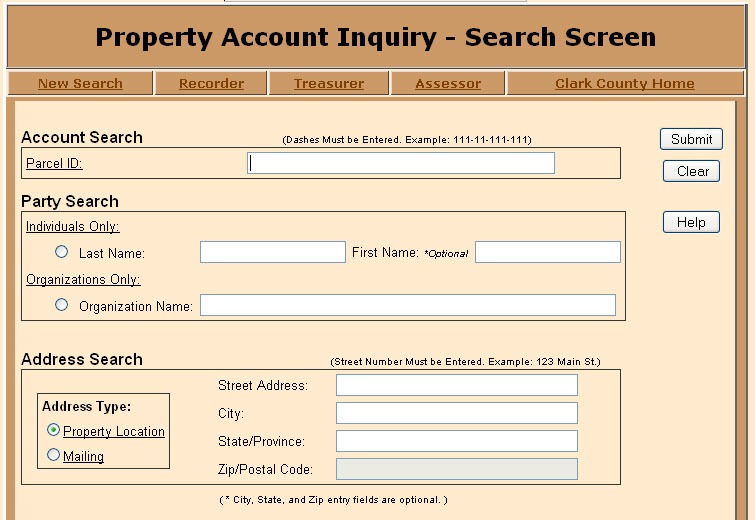

111-11-111-111 Address Search Street Number Must be Entered.

. You are then taxed at the above rates for every 100 of assessed value. Please verify your tax cap. We always look for reputable property tax lenders to add to our Las Vegass vendor list.

Make Real Property Tax Payments. Nevada is ranked number twenty four out of the fifty states in order of the average amount of property. Facebook Twitter Instagram Youtube NextDoor.

Property owners only have until Jan. Which may also include real estate taxes and a portion of the. These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more.

Without caps Nevada counties would have collected about 31 billion in property tax in FY 2016. Instead more than half a billion of that 549 million was abated according to Applied Analysis a fiscal consulting firm hired by the Legislative Counsel Bureau in 2019. Harry Reid 1939-2021.

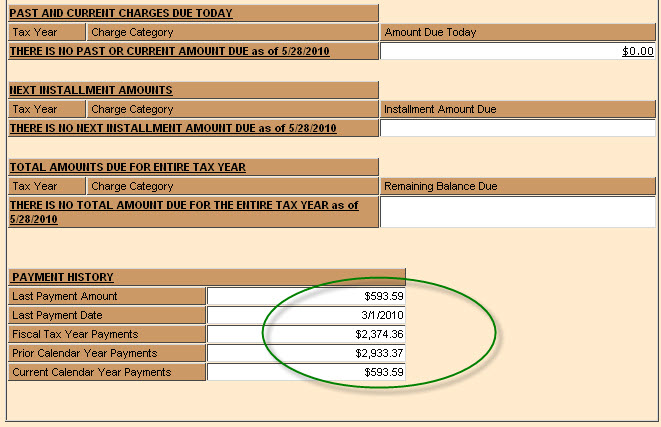

If you did not receive a tax bill you can request a bill by calling our office at 702 455-4323 and selecting option 3 from the main menu. Las Vegas NV 89155-1220. In addition Nevadas tax abatement law protects homeowners from sudden spikes in their property taxes.

Census Bureau compiled by WalletHub. Checks for real property tax payments should be made payable to Clark County Treasurer. Treasurer - Real Property Taxes.

They must be paid on time in order to avoid penalties. If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments call our office to request a bill at 702-455-4323 option 3. Property Tax Rates for Nevada Local Governments Redbook.

Please verify your tax cap. Accounts that are currently in seizure status cannot be paid on this page. If you do not receive your tax bill by August 1st each year please use the automated telephone system to request a copy.

LAS VEGAS Nevadas two-step property-tax assessment and billing system gives unsuspecting property owners no chance to contest their tax bills unless they carefully monitor assessment notices that county assessors must mail to them by Dec. Tax bills requested through the automated system are sent to the mailing address on record. If real property is purchased during the fiscal year or if a mortgage company is no longer.

If you did not receive a tax bill you can request a bill by calling our office at 702 455-4323 and selecting option 3 from the main menu. Nevada Property Tax Rates. The assessed value is equal to 35 of the taxable value.

Zillow has 3395 homes for sale in Las Vegas NV. With our guide you will learn important information about North Las Vegas property taxes and get a better understanding of what to expect when you have to pay. Make Personal Property Tax Payments.

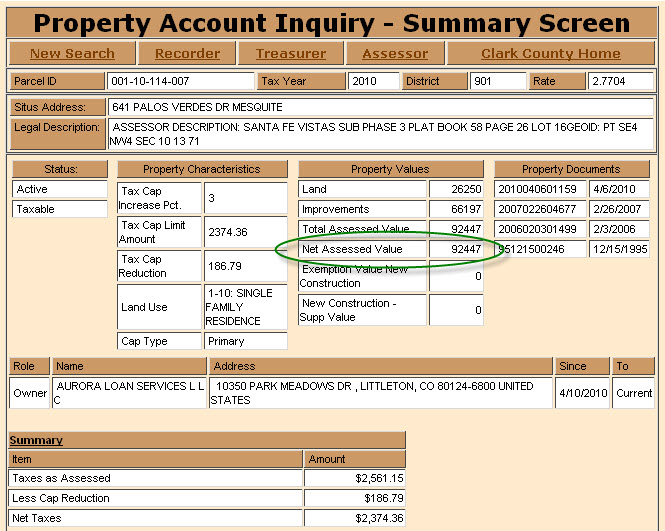

Failure to receive a tax bill does not relieve the responsibility for timely payment nor constitute cause for cancellation of penalty andor cost charges if the tax bill becomes delinquent. Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be 35000. Apply for a Business License.

If you are contemplating becoming a resident or just planning to invest in the citys property youll come to understand whether the citys property tax statutes are favorable. A previous version of this article incorrectly stated. A home that is found to be valued at 200000 and given that the property is assessed at 35 of current value this home would show an assessed value of 70000.

Contact the Assessors Office at 702-455-4970 for payment options. To ensure timely and accurate posting please write your parcel number s on the check and include your payment coupon s. If this is your primary residence and your tax cap is not 3 please call the Assessors Office at 702 455-3882.

If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans for residential and commercial property owners in. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites.

The Clark County Assessors Office does not store your sensitive credit card information. Thus even if home values increase by 10 property taxes will increase by no more than 3. Whether you are already a resident or just considering moving to Las Vegas to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

15 to determine whether they want to contest the taxable value of. Tax amount varies by county. Youll also have a lot of that money still in your pocket after youve paid your bills compared to say California New York or Hawaii.

NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Annual taxes on Nevadas median home. Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. Supplemental tax bills are only mailed to the property owner of record. 123 Main St City State and Zip entry fields are optional.

Thus if your tax rate is 325 and your assessed value is. Please verify your mailing address is correct prior to requesting a bill. 500 S Grand Central Pkwy 1st Floor.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Judging the Judges 2019. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook.

Enjoy the pride of homeownership for less than it costs to rent before its too late. Nevadas effective property tax rate calculated as a percentage of home value is among the lowest in the nation at about 70 percent according to data from the US. IF I PAY TAXES THROUGH AN IMPOUND ACCOUNT WILL MY SUPPLEMENTAL TAX BILL BE SENT TO MY LENDER.

Property Account Inquiry - Search Screen. The property tax rates for most all of Clark County range from 24863 to 33552 for the tax year 2008-2009. Find My Commission District.

1614 You may be able to blow a ton of money in Las Vegas but homeowners in this state dont have to. Tax rates in Nevada are expressed in dollars per 100 in assessed value. There are currently 3395 red-hot tax lien listings in Las Vegas NV.

084 of home value. Nevadas property tax rate is constitutionally limited to five percent of assessed value not market value. Hawaii has the lowest rate 27 percent and.

Tax rates apply to that amount. Grand Central Pkwy Las Vegas NV 89155. Supplemental tax bills are separate from and in addition to the annual secured property tax bill.

If this is your primary residence and your tax cap is not 3 please call the Assessors Office at 702 455-3882. Account Search Dashes Must be Entered. Las Vegas NV 89106.

Learn all about Las Vegas real estate tax.

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Understanding Your Residential Bill

Lending Approval Process Real Estate Tips Lending Underwriting

Developer Plans Apartment Tower Near Downtown Las Vegas Downtown Las Vegas Las Vegas Real Estate Las Vegas Boulevard

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

818 Stewart Las Vegas Nv 89101 Las Vegas Property Records Property

Taxpayer Information Henderson Nv

Mesquitegroup Com Nevada Property Tax

9511 Kings Gate Ct Las Vegas Nv 89145 Realtor Com Las Vegas Luxury Las Vegas Las Vegas Homes

Taxpayer Information Henderson Nv

Home Closing Delayed In 2021 Selling House How To Plan What Happens If You

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

What Is The Tax Impact Of A Short Sale Mortgage Payment Bank Owned Homes Homeowners Insurance

Mesquitegroup Com Nevada Property Tax

Tax Bill Nalog Na Nedvizhimost Tomi Nedvizhimost

24 Sawgrass Ct Las Vegas Nv 89113 Realtor Com Las Vegas Vegas The Neighbourhood

Usa Las Vegas Valley Water District Lvvwd Utility Bill Template In Word Format Bill Template Las Vegas Las Vegas Valley

Addictedrealty Buysellrepeat Lasvegasrealestate Addictedway Lasvegashomes Lasvegasrealty Lasvegasproperti First Home Buyer Real Estate Advice Tax Refund